A bright spot in energy M&A has been in the midstream. What’s driving this and where will it go from here?

Steady dealflow in the midstream this year has been driven by both a pull from public strategics and a push from secondary investors. There has been a focus on assets in the Permian Basin of the southwest, but buyers are also targeting specific businesses to complement their operations, notably natural gas liquids and terminals. Management of produced water has also been an active segment.

“This year we’ve seen substantial positive tailwinds for the midstream sector that we believe are here to stay,” says Gregory King, strategic managing partner at EnCap Flatrock Midstream. “Buyers are healthier than ever and remain focused on opportunistic M&A with immediate synergies. Additionally, financial acquirers are returning to the space in a trend that we’ve benefited from this year.”

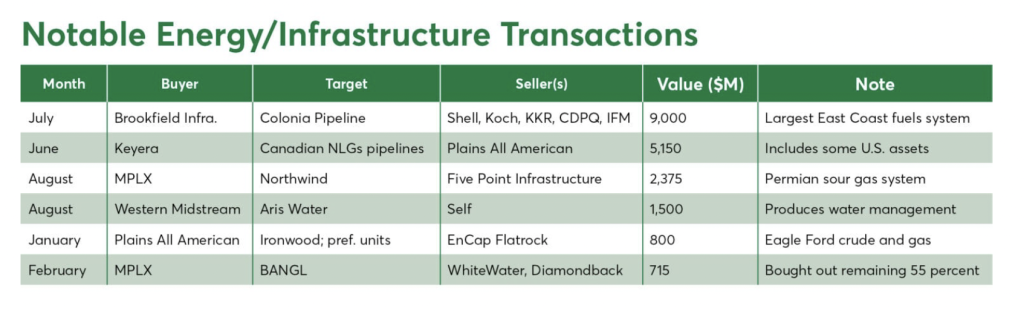

EFM got the ball rolling in January with a pair of private-to-public transactions. It sold Ironwood Midstream Energy Partners II, and all EFM-owned and outstanding Plains Series A preferred units to Plains All American (Nasdaq: PAA) for more than $800 million cash (see table).

“Hydrocarbons have become broadly recognized as affordable, critically reliable energy sources needed for many decades to come,” King added. “Natural gas specifically is in the midst of a full-blown super-cycle driven by demand dynamics globally in the form of LNG, and domestically via data-center power requirements. These dynamics stand to benefit every segment of the midstream value chain, from wellhead gathering to demand delivery.

“Wellhead businesses are once again in high demand, receiving premium valuations when they have access to meaningful gas and gas-liquids volumes or are proximate to growing demand centers,” he said.

Cresta Fund Management completed in September what is essentially a cross-fund sale by which a Cresta-managed fund backed by Endurance Investment Partners bought out the LPs in Cresta’s Energy Fund I to become a major investor in Enercoast Midstream, which connects Gulf Coast terminals to refineries and export terminals.

Cresta invested in Enercoast in 2021 out of Energy Fund I. “That investment has performed well,” says Managing Director Wade Webber. “We wanted to provide existing investors liquidity at attractive valuations while deploying capital into growth opportunities around the existing Enercoast asset base, and we are working on a few of those. We also see room to partner or pursue additional joint ventures along the Gulf Coast as the right opportunities emerge.”

Enercoast is a subsidiary of Cresta’s portfolio company, Sentinel, which will continue to manage the operation. “Sentinel is well positioned to accelerate its strategic development and capitalize on midstream opportunities along the Gulf Coast,” says CEO Jeff Ballard. Executives at Cresta and Endurance have worked together in midstream investing going back many years.

“The Gulf Coast is a great investment environment,” says Webber, “and Sentinel is a top-tier service operator. Specific to private equity, there is a growing pool of secondary capital eager to provide liquidity to operators and managers with proven track records and growth opportunities.”

Another notable private-to-public deal was the purchase of Northwind by MPLX (NYSE: MPLX) from Five Point Infrastructure. “There is a clear push to add Permian exposure, with buyers targeting assets that slot directly into their systems,” says Jaxson Fryer, energy analyst in capital intelligence at East Daley. “MPLX’s Northwind deal is about entering the sour-gas corridor in the northern Delaware Basin and securing NGL-rich volumes onto its pipes.”

Article published by The Middle Market M&A on August 6, 2025 – https://www.themiddlemarket.